OWEN FUGIT / ASSISTANT OPINION EDITOR

Students studying late on the night of Oct. 19 probably noticed something strange happening online a few minutes past midnight: loading screens and error messages.

Personally, I tried doing my online Spanish homework, but the webpage would just not load no matter how many times I restarted my computer, and no matter how long I waited. That morning, Oct. 20, brought an unexpected explanation for this incident: Amazon Web Services (AWS), a cloud-computing service, experienced a minor error — causing a ripple effect that subjected many web-based applications to a halt.

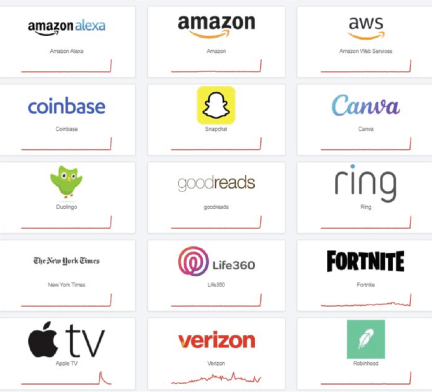

These are some of the many sites that were down during the AWS shutdown, causing a disturx-bance across the web. Photo courtesy of TheDustyBC/X

From Fortnite to Snapchat, to services like Apple Music and Life360, the AWS outage had a profound impact on the internet. but what this outage reveals about the current state of our web infrastructure is more frightening than a loading screen.

Our dependency on a small handful of cloud-computing services is an issue that is rarely discussed, but can lead to serious consequences if we do not act soon.

For many people, Amazon is just an e-commerce company that is responsible for delivering anything from socks to garden sheds. What most people may not understand is that AWS is one of, if not, the most profitable parts of Amazon as a whole.

AWS is essentially a digital landlord that rents out powerful computing, storage and artificial intelligence (AI) services to businesses who require it, but do not have the funds to support their own local infrastructure.

Take Canvas, for example: owned by Instructure, an educational technology company, Canvas is used by nearly 40% of U.S. higher education institutions, USD included. While Instructure is certainly a wealthy company, Canvas’s real home is the cloud-computing servers that Instructure pays for.

These servers are ran by companies like AWS, and when AWS’s servers experience an error — major or minor — it can effectively freeze websites like Canvas in an instant, until AWS fixes the issue. Just like a landlord, if the pipes clog, everyone has to wait for the landlord to fix it. Regardless of each individual’s wealth, there is very little they can do to fix the problem. This is what we saw during AWS’s recent outage. A breaker tripped, and the internet had to wait for AWS to fix it.

The main issue at the heart of this outage is the fact that AWS commands around 30% of the global cloud infrastructure market, outpacing even Microsoft, which boasts a 20% stake. When we give one company that much influence and power, we cannot be surprised with the impact an error has.

Amazon has a clear incentive to grow their cloud-computing services, especially in an industry making hundreds of billions of dollars each year. If we continue to give AWS, Microsoft and Google — colloquially known as the “Big Three” cloud-computing companies — more money and more control, we risk paying our way into an oligopoly that will be much harder to escape than it is to join.

It is certainly incorrect to view cloud-computing as a blemish — these services make it possible for hundreds of thousands of businesses of all shapes and sizes to access game-changing technology at quite an affordable price. So there is certainly a need for cloud-computing services.

However, as any economics student knows, the best markets are made up of many sellers, competing for many buyers. The more sellers there are in a market, the better price options buyers have. This creates competition, and allows a true market to find the right price for the right service with the right provider.

The issue with AWS and the “Big Three” cloud-computing giants is the fact that they do not have to compete nearly as hard with each other to attract a sizable chunk of the market. In AWS’s case, being the first, largest, most recognizable and most popular cloud-computing provider gives them a unique advantage over even Microsoft and Google.

If we want to mitigate the fallout from the next AWS outage, we must demand that the companies whose products and services we depend on diversify their cloud-computing choices. But to demand that, we must also support efforts on the national level to break up monopolies before they become too powerful and before we become too dependent on them.

However, trust busting is a lengthy, difficult process, and we have no idea when the next outage could strike, which is why schools like USD must look to reduce their dependence on AWS as well.

During the outage, I was unable to access the course catalog on USD’s website, and I am sure that there were many other pages on USD’s website that also went down, which is why I think it is fair to ask that USD does not spend our money propping up a budding monopoly that has the chance to take away or limit our access to critical services and materials at any given moment.

The University responded in a written statement.

“Many Fortune 500 companies/products, including Canvas, Workday and many others, trust AWS because of its strong historical reliability,” the statement read. “AWS services are known for their high reliability, with published uptime figures near 99.99%. However, no cloud platform is immune to service disruptions outages. USD has no control over which cloud providers are used by Canvas or other software vendors – that means that we cannot diversify the cloud service providers for these products.”

Thankfully, the AWS outage occurred due to a tiny error, and only affected a small portion of their customers. But what are we to do when AWS has a serious problem, or if AWS suffers a cybersecurity breach?

Our best course of action would be to allow more competitors to break into the cloud-computing market. This would offer services tailored to specific kinds of businesses on a local or regional level, and hopefully pressure our institutions to not support monopolistic firms.

Students lost access to a number of online services including Canvas, leaving students unable to complete many assignments. Photo courtesy of @TheDustyBC/X

Leave a comment